Across the payment industry, the certification mechanism is in place to verify that members or clients can correctly format and securely process financial messages, as well as stay current with the never-ending stream of card scheme mandates and technology changes.

In this guide, we explore some of the key concepts and challenges with the current certification environment, while providing advice and guidance on how to work within, as well as improve the process.

Most card brands, networks and payment processors have specific certification requirements for any members who issue credit and debit cards or acquire card-based payments.

The certification process helps ensure that network members or users are able to correctly format, send and receive messages to and from the networks.

Certification is a fundamental way for the payments industry to ensure that consumer payment transactions are accurate, secure and can flow freely on the existing “rails” that connect all industry participants.

And with consumers becoming both more sophisticated and more demanding, it is increasingly important that every single payment transaction is executed perfectly every time.

Similarly, fraudsters are more aggressive and more technically savvy than ever before. The certification process is one of the most important tools that the payment industry uses to help ensure the overall safety and stability for the retail payments ecosystem.

In this guide, we explore everything from the importance of certification, to the common challenges businesses experience and how they can be resolved.

Given the critical role that certification plays in protecting the payment industry, one might assume that the process is always well documented, highly efficient, and extremely accurate. While this may be true in some cases, far too often the processes are actually very manual, very slow, and not very accurate.

As important as the certification process is to the overall safety and security of the payment industry, many organizations are still using the same basic methods and mechanics that they developed back in the 1980’s and 90’s. These legacy processes are slow, error-prone and expensive for both the certifying organization and its members/clients.

In fact, according to Roboyo, a global leader in process-centric solutions: “Without a centralized and automated certification system, financial services organizations are faced with a long list of inefficiencies; siloed data and processes, low quality data, siloed departments and users, operational challenges and lack of visibility being only the tip of the iceberg.”

Here are a few key challenges that the industry faces by maintain legacy certification systems, tools and processes:

For many industry participants the certification process can take weeks or even months to complete. The exercise is time-consuming and expensive for all parties - unnecessarily tying up valuable resources and preventing businesses from focusing on more strategic activities that drive real value for their customers and their shareholders.

The goal of certification is to ensure that industry participants can correctly and securely process payment messages and transactions. Logically, we assume that current, accurate data is a prerequisite for efficient execution of this exercise.

Unfortunately, there is still widespread reliance on paper documents, spreadsheets and PDFs to share certification related data. Many organizations continue to create and maintain their certification data, scripts and requirements documents manually.

The complexity, expense and time required to maintain the certification data almost guarantees that it is not kept as current and accurate as it could and should be, further compromising the speed, efficiency and accuracy of the certification process.

The proliferation of networks and payment gateways, along with the advent of new payment methods and technologies (such as EMV contact and contactless cards) means the time and effort required for certification and recertification is greater than ever.

Legacy tools, manual processes, and lack of automation all add to the cost and complexity of the certification process, making it increasingly difficult for industry participants to optimize their testing operations and protect their bottom line.

Are you experiencing one or all of these challenges? In this guide we are going to explore how technology can help you centralize and automate certification processes.

As previously indicated, certification is an important subject for any card brand, network or processor – one that can have a material impact on the health and profitability of the organization.

Not surprisingly, the faster a payment network is able to onboard and certify new clients and members, the quicker it is able to start bringing in new revenues. So the continued use of antiquated systems, tools and processes is problematic.

The Roboyo article referenced earlier in this guide suggests that the future for businesses using this legacy centric approach includes “lost opportunities, steadily increasing costs, decreasing conversion, deferred revenues and a reduced ability to compete in the marketplace with their more tech and data-savvy competitors.”

When done correctly, automated and optimized onboarding and member certification can:

Networks that implement technologies to improve their onboarding processes are able to reduce certification and onboarding timeframes, lower the cost to acquire new customers, grow their revenue opportunity and improve customer retention levels.

There can be no doubt that the certification process plays a significant role in protecting the retail payment industry for all stakeholders, including the consumer.

However, it must be noted that the process is clearly under the control of the card brands and networks, with rules and requirements flowing downhill through processors to individual issuers, acquirers, and retailers at the end of the line.

All clients and members of a payment network have an obligation to follow the “rules of the road” for that network to ensure that every consumer transaction is processed, quickly, correctly and securely.

And these rules must be followed. Failure to do so can carry a number of negative impacts including, higher interchange rates, increased chargebacks, fines or penalties, and for the most serious offenses, a network may even refuse to accept transactions from an offending member.

Further complicating the certification discussion for members is the fact that even though virtually all retail financial messages and transactions are based on a common ISO 8583 standard, each network has its own unique interpretation and variation of the standard, as well as its own specific certification requirements and timeframes.

How frustrating it must be for members to sort through financial messages and transactions provided via Excel spreadsheets or PDF documents and then book time on the phone to speak with an expensive network certification analyst - a limited resource who may not be available for days or weeks – in order to work through the certification process.

Given the importance and complexity of the certification effort - especially when multiple payment networks are involved – issuers, acquirers and merchants should use all of the resources available to ensure that the organization is always ready and well prepared when it comes time to certify.

By using technology like Paragon Web FASTest to pre-certify, your organization can reclaim some control over the certification process and realize a number of benefits, including:

Leveraging technology enables both networks and members to centralize and automate the management of their certification processes. This helps streamline the entire certification process, saving organizations time, money and valuable resources.

Rather than having valuable resources spend hours sorting through paper documents or on the phone working through certification tests one at a time, wouldn’t it be better to have a centralized and automated system in place to help manage and optimize the certification process?

Implementing modern technology to enhance the certification process will:

The wide range of national, regional and international variations of the ISO 8583 standard in use today has resulted in the complex web of legacy payment interfaces that exists today. This vast array of “standards” makes it difficult for QA teams, testers and IT departments to handle onboarding, payment testing and managing ongoing partner relationships.

It is hoped that the pending migration to ISO 20022 will eventually impact this environment positively by providing a modern messaging framework that allows for financial information to be seamlessly shared on a global basis. With that said, there will no doubt be some challenges and teething pain during the migration to ISO 20022.

In the short-term there is still a tremendous opportunity to leverage modern technologies, such as virtualization and automation to improve the efficiency and accuracy of current certification processes, reduce costs and increase client satisfaction.

The most effective way to do this is through online certification, and the use of a cloud-based certification system that allows for testing anywhere and anytime. This helps organizations implement efficient testing processes and collaborative work environments.

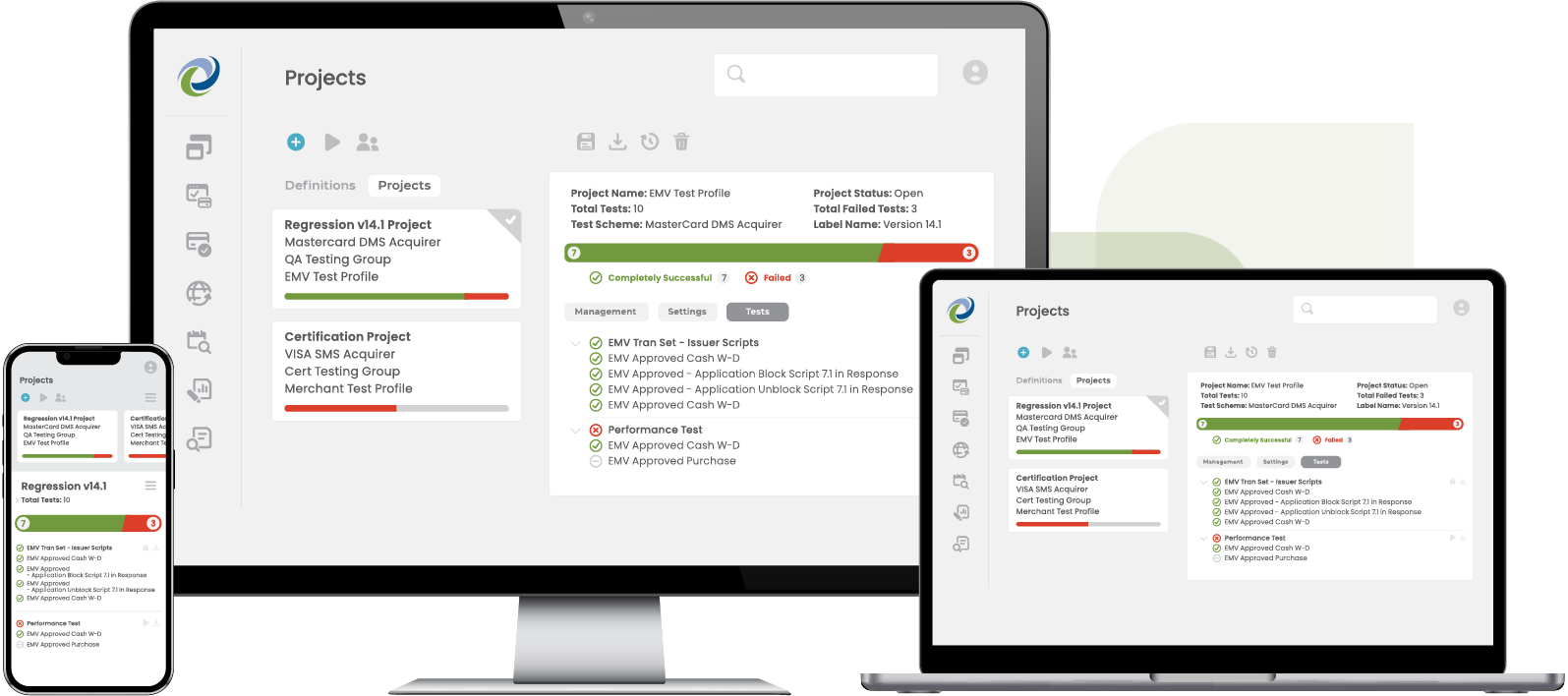

To help, Paragon Application Systems has developed its innovative Web FASTest platform to make certification testing a more efficient exercise for both networks and their members.

The Web FASTest platform can run unattended, 24x7x365, to provide networks, processors and their members with anytime, anywhere access to the required tests, test data and reports for tracking the progress of certification projects.

Through the use of a self-certification platform, organizations are able to achieve faster certification times that lead to dramatically reduced project timeframes, improved certification testing quality, enhanced project management capabilities, and reduced costs.

Deploying an automated self-certification platform, specifically designed to address the unique requirements of your organization, can reduce project timeframes from weeks and months to days - improving your time-to-value and increasing customer satisfaction.

Interested in learning how you can overcome these challenges? Contact Paragon Application Systems today.

No matter if you are a card brand, a network, or a processor who certifies its members - or a member who must certify with one of these organizations, Paragon has solutions that can help ease the certification burden. Talk with us to find out more.

Copyright © 2026 All Rights Reserved by Paragon Application Systems | Terms of Use | Privacy Policy | Powered By Meticulosity